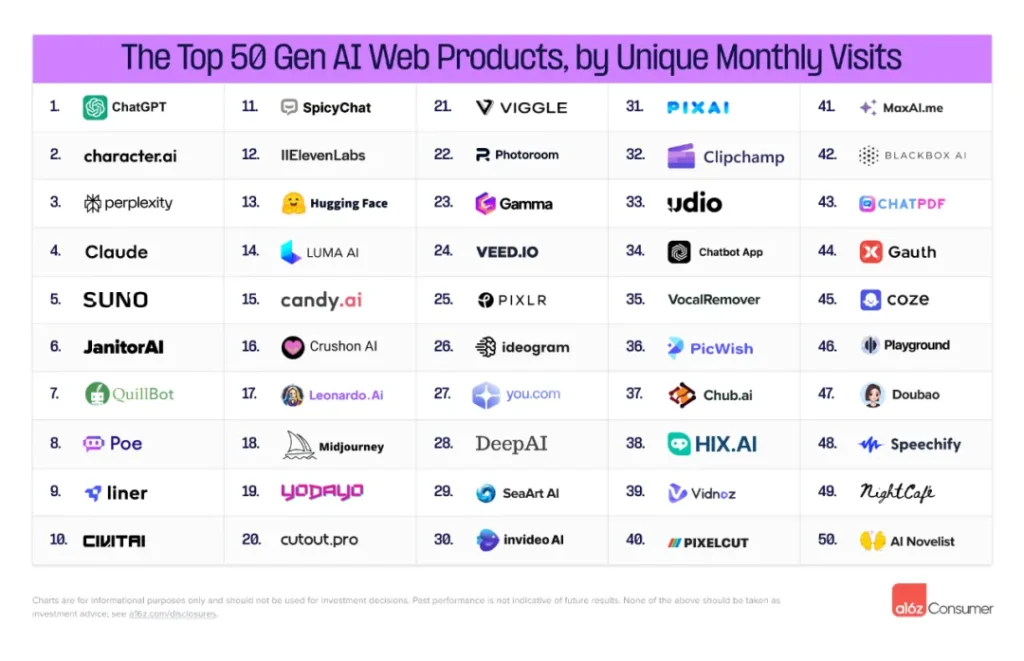

Half a year later, a16z has released the third edition of their global AI product Top 100 list. Some noteworthy points: 30% of the companies are new compared to six months ago; mobile applications with the highest usage are image and video editing, accounting for 22%; Claude is aggressively catching up to ChatGPT; the majority of new products come from Chinese teams, especially ByteDance; AI dating is an emerging growth category; Discord traffic is noteworthy, with many applications completing PMF validation on Discord.

Every six months, we conduct an in-depth analysis of data, ranking the top 50 AI-first web products (ranked by monthly unique visitors) and the top 50 AI-first mobile applications (ranked by monthly active users). Compared to the report in March 2024, nearly 30% of the companies in this report are new. March report: a16z Global AI Product Top 100: 22 new companies on the list, music and productivity tools rise, AI companionship products become mainstream. However, beyond the allure of brand logos on these rankings, the data also reveals some noteworthy trends around emerging and expanding categories, emerging competitors, and participation patterns. Here are some of our key takeaways: Click to follow for daily updates on in-depth AI industry insights. 01 Creative tools dominate, with video and music generation on the rise. The magic of creative tools continues to attract consumers. Among the listed companies, 52% focus on content generation or editing, covering various forms – images, videos, music, voice, etc. Among the 12 new companies, 58% are involved in the creative tools sector. This includes four of the top five new companies on the list: Luma (14th place), Viggle (21st place), SeaArt (29th place), and Udio (33rd place). The biggest riser in the past six months is the music generator Suno, whose ranking soared from 36th to 5th. In our previous lists, most content generation tools were concentrated in the field of images. However, in the past six months, momentum for other forms of content generation tools has grown: image generation alone accounts for 41% of the top content generation websites. Among the five new generation tools that debuted, only SeaArt specializes in images.The video field has welcomed three new members (Luma, Viggle, and Vidnoz), and the music field has a new tool (Udio) – both of these two fields have made huge leaps in output quality in the past year.

What about the mobile side? Content editing of pictures and videos is the most common application. Accounting for 22% of the list, it is the second-largest product category on mobile – users are enthusiastic about editing content on their phones. Although startups are also making a name in this field, many of the top new entrants on the list are traditional creative tools that have transformed to have generative AI at their core, such as Meitu (#9), SNOW (#30), and Adobe Express (#35). 02 ChatGPT’s Advantage is Diminishing For the third time, ChatGPT has become the number one product in web and mobile rankings by a large margin. However, the competition to be the best consumer assistant is intensifying. Perplexity is currently ranked third in web search – this AI-driven search engine is committed to providing concise, real-time, and accurate query answers, along with citation sources. According to Similarweb data, Perplexity slightly outperforms ChatGPT in visit duration (over seven minutes), indicating deep user engagement. In addition, Perplexity has made it into the top 50 list on mobile for the first time. Anthropic’s Claude, which can be said to be a direct competitor to ChatGPT, has risen to the 4th place in the web ranking, up from the previous 10th place. The company recently launched Artifacts, competing head-on with ChatGPT’s GPTs. On mobile, the AI assistant Luzia made its debut at the 25th place – the company claims to have 45 million users globally, mainly Spanish speakers. Luzia was initially launched as a chatbot based on WhatsApp but launched an independent mobile app in December 2023. 03 ByteDance Enters the Game, 3 Apps on the List for the First Time ByteDance, the parent company of TikTok, is actively entering the field of web-based artificial intelligence products. Three of its apps have made their first appearance on our list: the edtech platform Gauth (#44), the robot-building tool Coze (#45), and the general assistant Doubao (#47).Doubao made its debut in the mobile app rankings, securing the 26th position. Alongside Doubao, photo and video editor Hypic (#19) and assistant Cici (#34), both also from ByteDance, collectively occupy six spots in the two lists. These apps target different geographical markets; on mobile, Cici is the English version of Doubao’s Chinese version. Why is there a surge of new entrants? At the end of 2023, ByteDance established a research and development department named Flow, focusing on generative AI applications. Since the beginning of 2024, they have been launching new AI applications in the United States (and overseas) under other company names.

A new category: AI Beauty and Dating has been added on both web and mobile platforms, featuring three emerging companies: LooksMax AI (#43), Umax (#44), and RIZZ (#49), all ranking in the mobile list. LooksMax and Umax apps read user photos for scoring and provide ‘beauty tips’. Umax can also generate a virtual image of the user with a perfect beauty score, while LooksMax assesses attractiveness by analyzing the user’s voice. On the app’s guidance page, LooksMax claims to have over 2 million users, and Umax claims 1 million users. Both apps monetize by unlocking results through paid subscriptions: Umax charges $4.99 per week (or by inviting three friends), and LooksMax charges $3.99 per week. On the other hand, RIZZ focuses on enhancing message interaction in dating apps. Users can upload conversation screenshots or profiles and receive advice on how to respond. Messages can be directly copied from RIZZ to dating apps. Discord is very useful for growth. In many cases, traffic on Discord is a leading indicator of apps that will rise in the rankings of web and mobile applications, especially in the content generation field. Some products are released on Discord to test in ‘sandbox’ mode and build communities before launching official websites and primarily migrating out of Discord. These products ‘graduate’ from Discord’s top rankings (a typical example is Suno, which ranked 31st in Discord traffic in the last list but did not enter the top 100 Discord servers this time).Other companies maintain significant Discord usage even after launching standalone products. For instance, Midjourney consistently ranks at the top in terms of invite traffic across all Discord servers. As of July, ten AI companies have made it into the top 100 invite traffic of all Discord servers. Compared to January, half of them are newcomers: among the top ten Discord servers, half allow users to generate content within Discord, usually through paid subscriptions; while the other half utilize Discord for community building, customer support, and resource sharing.

The distribution of countries of origin for applications and products in the list is evident. Clearly, a new generation of AI-native products and companies is growing at an unprecedented rate and engaging users more deeply. We believe that AI will become the cornerstone of companies defining industry categories within the next decade.